You operate in a payments environment where shifting customer expectations, rising fraud pressure, regulatory scrutiny, and evolving card network rules directly shape your revenue, customer retention, and the cost of running your payments stack.

Card network tokenization changes how those forces interact.

Instead of storing and transmitting primary account numbers, you transact on credentials issued and maintained by the card networks themselves. Those credentials remain valid when cards are reissued, authenticate at the network layer, and move across gateways and processors with stronger issuer confidence. This creates a system where credentials support long-term stability across providers, regions, and transaction types.

Spreedly enables this through its Advanced Vault and orchestration layer, allowing you to store, route, and retry transactions using network tokens alongside processor tokens and vaulted Primary Account Numbers (PANs). The result is a payments stack that remains portable, adaptable, and resilient across providers, regions, and business models rather than one defined by the limitations of a single gateway integration.

What is network tokenization?

Network tokenization is when the card networks themselves, like Visa, Mastercard, American Express, and Discover, issue the token. Instead of your gateway or vault creating a stand-in for the card number, the network provides a credential that works across the acquiring ecosystem.

The token becomes the credential that moves through the authorization, clearing, and settlement process. It is domain-restricted, meaning it is tied to a specific merchant, device, channel, or transaction context. It is lifecycle-managed by the network. When an issuer reissues a card because of expiration, fraud, or routine updates, the token is refreshed automatically without requiring the cardholder to take action.

For merchants, network tokenization creates a model where credentials remain usable across changes in providers, fraud events, and card lifecycles. For issuers and networks, it creates a stronger authentication signal tied to a known merchant and transaction context. For customers, it removes friction from recurring and repeat purchases.

Spreedly’s role in this system is to give you a control layer above the networks and gateways. You can store network tokens securely, decide how they are used across providers, and design routing and retry strategies that prioritize performance rather than compatibility.

What network tokenization means in production

Token provision meaning becomes clear when a transaction enters a live environment rather than a test console.

When a customer enters their card details, the card network can replace the PAN with a token at the point of capture or during storage. That token is provisioned to you as the merchant and becomes the credential used for future transactions. It is authenticated at the network level using merchant-specific and transaction-specific data.

In practice, this creates measurable outcomes.

Stored credentials remain valid when cards are reissued. Issuers receive stronger signals about where and how a transaction is being used. Sensitive PAN data no longer needs to move through your infrastructure or your providers’ systems.

Spreedly’s orchestration layer allows you to apply logic to those credentials instead of treating them as static records. You can route a transaction using a network token to one processor, fall back to a vaulted PAN for another, or retry through a different acquirer entirely. The credential remains portable even when your provider strategy changes.

That portability turns tokenization into a performance tool rather than a narrow security control.

How PCI tokenization works

PCI tokenization is designed to reduce the exposure of PAN data inside a specific environment. A gateway, vault, or internal system replaces the PAN with a token that is meaningful within that ecosystem. The token can be stored and used internally, but it is not recognized outside the system that created it.

This approach is effective for shrinking PCI scope and limiting the impact of a breach. It allows merchants to avoid storing raw card data while still maintaining references to stored credentials.

The limitation appears when infrastructure changes. Processor tokens typically cannot move between gateways. Vault tokens often cannot be used outside the environment in which they were created. When you expand into new regions, add local acquirers, or shift volume for cost or performance reasons, credentials can become constrained by older integrations.

PCI tokenization protects data within a defined system. It does not maintain continuity across a changing provider landscape.

How network tokenization works

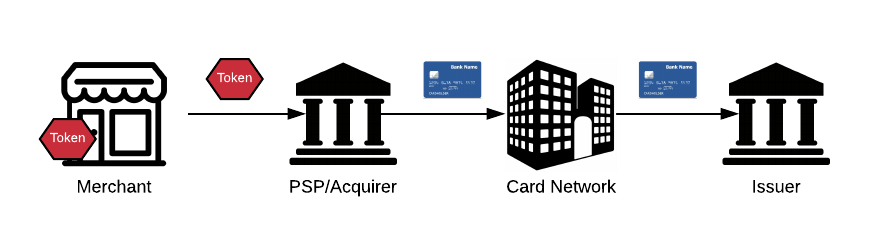

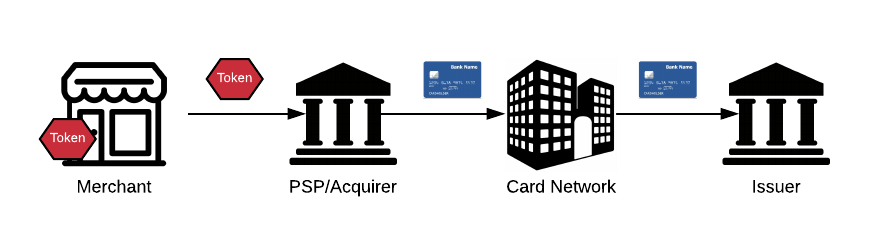

Network tokenization operates at the card network layer rather than the provider layer.

When a PAN is tokenized by the network, the token becomes a network-recognized credential. It is domain-restricted, meaning it is tied to a specific merchant or use case. It is lifecycle-managed, meaning it is updated when the underlying card changes. It is authenticated using network-level controls that issuers trust more than static card numbers.

Now, you’ve got a system where credentials can move with you as your payment method and gateway strategy evolves. The same token can be used across multiple providers, channels, and regions, subject to the rules of the network and the domain in which it was provisioned.

Spreedly enables this by storing network tokens in its Advanced Vault and making them available across your provider network. You gain the ability to treat credentials as part of your routing and optimization strategy rather than as artifacts of a single integration.

Network tokenization in a modern payments environment

Digital commerce has become the default operating model for many industries.

Subscription businesses depend on uninterrupted renewals. Marketplaces depend on consistent settlement across sellers and regions. Travel and hospitality depend on delayed capture and stored credentials. Enterprise retailers depend on approval rates that hold steady at scale.

At the same time, fraud pressure continues to rise, regulatory requirements grow more complex, and card networks introduce new rules around authentication, token usage, and interchange incentives.

Network tokenization provides a way to maintain customer experience, improve issuer confidence, and reduce operational complexity while supporting growth across regions and business models.

What are the benefits of network tokenization

The benefits of network tokenization for businesses extend across security, revenue performance, operational efficiency, and strategic flexibility. These gains appear in how approvals, retention, compliance, and provider management behave at scale.

Increased security without added friction

Network tokens remove the need to store or transmit PAN data through your systems. The token has no value outside the domain in which it was provisioned and cannot be used in another merchant environment or transaction context.

Each transaction is authenticated using merchant-specific and network-level controls. This reduces the usefulness of stolen data and lowers the risk profile of your stored credentials.

From a compliance perspective, this shrinks PCI scope and simplifies audits. From a customer perspective, it improves security without introducing additional steps at checkout.

Reduced declines and higher issuer confidence

Issuers treat network token transactions differently from PAN-based transactions. The token signals that the transaction is coming from a known merchant in a known context. That increases confidence and reduces the likelihood of false declines.

Because network tokens are lifecycle-managed, declines caused by expired or reissued cards are removed from the equation. Customers do not need to update stored credentials. Merchants do not need to chase failed payments.

Over large transaction volumes, even small improvements in approval rates translate into meaningful revenue recovery.

Operational efficiency across the payments stack

Network tokenization reduces the number of processes required to maintain stored credentials. Card updater programs become embedded in the token lifecycle. Support tickets related to payment updates decline. Retry logic becomes more effective because credentials remain valid across attempts and providers.

Spreedly extends this efficiency by allowing you to apply the same token strategy across gateways and acquirers. You optimize the stack as a system rather than as a collection of point integrations.

Strategic flexibility and portability

When credentials are tied to a single provider, infrastructure decisions become difficult to reverse. Network tokens reduce that dependency.

You can add providers, change acquirers, expand into new regions, and test routing strategies without forcing customers to re-enter payment information. This creates leverage in commercial negotiations and resilience during outages or performance issues.

Why network tokens are different

Most tokenization strategies address localized requirements. Network tokens address structural requirements across a multi-provider, multi-region payments stack.

Processor tokens and PCI vault tokens exist inside closed ecosystems. They protect data and simplify compliance, but they bind credentials to the infrastructure that created them.

Network tokens operate at the network layer. They are recognized across the acquiring landscape and maintained by the same entities that govern authorization and settlement.

This distinction matters when you scale.

A merchant operating in one region with one gateway can treat tokenization as a storage decision. A merchant operating across regions, providers, and business models must treat tokenization as a system design choice.

This is where merchant tokenization becomes strategic. You’re deciding how credentials flow through your organization, your providers, and your markets over time.

Spreedly’s orchestration layer provides a control plane where network tokens, processor tokens, and vaulted PANs coexist. That allows you to select the best credential for each transaction based on performance, acceptance, and cost rather than technical constraints.

Businesses that benefit from network tokenization

Some industries see immediate impact because their revenue depends on continuity rather than one-time conversion. Any of this look familiar?

Subscription and membership platforms

Recurring revenue models depend on credentials that work silently in the background. A failed renewal often leads to churn rather than a retry.

Network tokens keep stored credentials current when cards are reissued or updated. That reduces involuntary churn, stabilizes monthly recurring revenue, and lowers the cost of retention campaigns and customer support.

A digital service with a large subscriber base can recover significant revenue by removing expired card declines from its payment flow.

Marketplaces and platforms

Platforms operate across multiple sellers, regions, and acquiring relationships. Credentials must move across that complexity without becoming constrained by a single PSP’s token system.

Network tokens allow platforms to maintain a consistent credential strategy even as they add local acquirers, optimize routing, or shift volume for performance and cost reasons. This becomes critical as platforms scale internationally and adopt region-specific payment methods and providers.

Travel, ticketing, and hospitality

These industries rely on delayed capture. Cards are stored at booking and charged later, sometimes weeks or months after the initial transaction.

Network tokens reduce the risk that a valid booking turns into a failed settlement because the card was reissued between purchase and capture. That protects both revenue and customer experience in high-value transactions where manual recovery is costly.

Enterprise eCommerce and retail

High-volume merchants operate at a scale where small changes in approval rates and fraud costs translate into large financial outcomes.

Network tokens improve issuer confidence, reduce false declines, and lower the operational cost of managing stored credentials. Combined with orchestration, they allow merchants to optimize performance across multiple providers rather than relying on a single gateway’s capabilities.

Reduction in the cost of fraud

Fraud has become a persistent operational expense.

Tokenized credentials reduce the value of stolen data because the token cannot be used outside its domain. This limits the impact of breaches, phishing attacks, and malware.

Network tokens also improve the quality of authentication signals sent to issuers. This reduces the likelihood that legitimate transactions are flagged as suspicious and declined.

Over time, this lowers both direct fraud losses and the indirect costs associated with chargebacks, manual reviews, and customer service.

Improved checkout and customer experience

Payment experience is defined by reliability.

Customers see fewer declines. They see fewer requests to update payment methods. They experience fewer interruptions in subscriptions, bookings, and saved payment flows.

This matters because failed payments often break trust rather than just transactions. A customer who intended to complete a purchase but is forced into manual recovery is more likely to abandon the process entirely.

Network tokens remove one of the most common sources of friction in digital commerce: outdated credentials.

PCI compliance and payment security

Network tokenization simplifies compliance by minimizing the presence of PAN data in your environment.

When tokens replace PANs in storage and processing, the scope of systems subject to PCI DSS requirements shrinks. This reduces audit complexity, security overhead, and operational risk.

Spreedly’s vaulting and orchestration layer reinforces this by centralizing credential management. You gain a consistent security model across providers and regions rather than managing compliance separately for each integration.

Cost savings and network incentives

Card networks increasingly encourage tokenized transactions through pricing structures and incentive programs. In some cases, non-tokenized transactions carry higher network or interchange costs.

Over large transaction volumes, small per-transaction differences accumulate into material financial impact.

Network tokenization allows you to align with network programs while maintaining flexibility in your acquiring strategy. You avoid locking yourself into a single provider’s token model in order to access network-level benefits.

Streamlined recurring and stored payments

Recurring and card-on-file transactions depend on credentials that remain valid over time.

Network tokens embed lifecycle management into the credential itself. When a card is reissued, the token updates. When fraud occurs at another merchant, your token remains unaffected because it is domain-restricted to your environment.

This protects revenue streams that operate on delayed or recurring billing models and reduces the operational cost of maintaining those systems.

Reporting on the ROI of network tokens

ROI from network tokenization appears across revenue recovery, cost reduction, and operational efficiency.

Authorization lift often provides the most direct signal. Even a one-point improvement in approval rates can represent millions in recovered revenue at scale.

Churn reduction is another indicator. In subscription and membership models, failed payments often lead to silent customer loss. Network tokens reduce involuntary churn by keeping credentials valid without customer involvement.

Fraud and compliance costs provide a third dimension. Tokenized credentials reduce the impact of breaches and simplify audits, lowering long-term security investment and operational overhead.

Interchange and network incentives provide a fourth. Tokenized transactions may qualify for favorable pricing structures and performance programs.

Spreedly’s analytics layer ties these outcomes back to routing, provider performance, and credential type. You can compare how network tokens perform versus PANs or processor tokens across gateways, regions, and transaction types. This allows you to treat tokenization as a measurable growth strategy.

Network token providers and how they fit into your stack

The major card networks operate their own token services, including Visa Token Service, Mastercard Digital Enablement Service, and American Express Token Service.

These providers issue and maintain the tokens that replace PANs at the network level. They manage credential lifecycle and authentication.

They do not manage routing, retries, or multi-provider strategies. That is where orchestration becomes essential.

Spreedly integrates network tokens into a broader payments architecture. You can provision tokens, store them securely, and decide how they are used across processors and gateways. The networks maintain the credential.

You control how it moves through your business.

How payment network tokenization fits into the broader tokenization landscape

Modern payment systems often use multiple token formats simultaneously.

Processor tokens, network tokens, and vaulted PANs can coexist within a single architecture. This redundancy creates resilience. If one credential type is not accepted by a provider, another can be used. If one provider experiences performance issues, transactions can be rerouted without forcing customers to re-enter payment information.

Spreedly gives you the means to design these systems intentionally. You decide how credentials are stored, which token types are preferred for which providers, and how retries are executed when transactions fail.

This turns tokenization into a system-level capability.

Network tokenization as a system

Network tokenization supports a model where credentials remain valid as customers’ cards change, transactions move as your acquiring strategy evolves, and providers compete on performance.

That’s what card network tokenization looks like when it’s applied across a full payments architecture.

If you want to see how Spreedly helps you operationalize network tokens across gateways, regions, and business models, talk to our payments team. The conversation usually starts with security and quickly moves to you’ll increase your revenue.

.png)