Payment gateways hold the key to online payments. Without them, you’d be hard-pressed to accept credit and debit card payments from customers, much less check them for fraud.

U.S. payment gateways are expected to reach a market value of more than $37.5 billion by 2032, growing at a rate higher than 18% annually from now until the target date.

A payment gateway acts as a portal between your digital storefront and banks. The gateway receives the transactional data upon payment initiation and sends that data to the relevant bank for approval.

Hosted payment gateways allow you to accept payments with minimal developmental or maintenance overhead. It gives your business a simpler means for managing complex compliance requirements that come with processing payments. These types of gateway solutions are well-suited to merchants and marketplaces that want to offer a streamlined payment experience to customers.

What is a Hosted Payment Gateway?

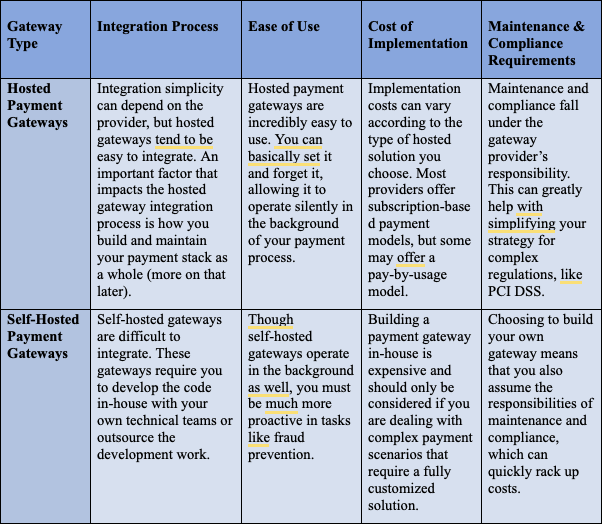

Payment gateways can be broadly categorized as either hosted or self-hosted.

A hosted payment gateway provides you with the technology needed to accept payments without having to build the code and application yourself. It connects to the back end of your checkout interface to an outsourced gateway solution that can be customized according to your needs. Almost all merchants opt for hosted payment gateways for simplicity and cost-efficiency.

Self-hosted gateways, on the other hand, are developed in-house. Typically, only very large enterprises even consider building their own gateway connection to an acquirer or processor.

Here’s a closer comparison of the two:

How are Hosted Payment Gateways Integrated?

Hosted payment gateways are built and managed by third-party providers. The most common way to connect to this kind of solution is through an API.

APIs, or application programming interfaces, are tools that allow you to plug external technology and software into your own website or applications. Payment gateway APIs specifically connect a gateway solution to your online storefront or marketplace. Without them, you would be unable to accept payments online and would need to rely on in-store POS systems or cash payments.

Typically, when using a hosted payment gateway, you will also need a hosted payment page that customers are redirected to when they proceed to checkout.

Hosted payment pages can be either pop-ups or separate windows that feature a payment form where customers enter their payment details, billing information, and other essential data.

Another popular type of hosted payment page is an iFrame, an HTML element that enables you to embed the page directly into your website and checkout interface. Many merchants prefer this option because it keeps customers on the same page and offers a more streamlined payment experience, though all hosted payment page types have their merits.

You can also choose to build your own payment page to maintain greater control of the checkout flow. However, just like with a self-hosted payment gateway, building a payment page in-house comes with additional compliance complexities and can be costly.

How Do Hosted Payment Gateways Work?

You may be wondering how this all works on a technical level.

Hosted payment gateways and hosted payment pages are often paired together as a bundled solution, though you can choose to build your own payment page. You can also opt for using different providers for your gateway and payment page, but doing so can complicate the integration process without the right tools or platform for working with multiple providers.

In general, however, hosted payment pages work as follows:

- API Integration: More than likely, whichever provider you choose will use APIs to integrate their payment gateway solution with your website or application. This integration process requires you to first create an account with the provider, after which you will be given credentials for accessing the API client interface. With the payment gateway API connected to your system, you can begin accepting online payments.

- Payment Initiation: A customer initiates a purchase with your business by choosing the products or services they want and then navigating to your checkout. Initiating payment brings the customer to a menu of payment methods you have enabled. After choosing their preferred payment method, the customer is redirected to the payment page.

- Redirection & Payment: As we’ve covered, the payment page can come in the form of an embedded iFrame, a separate window, or a pop-up. Depending on which payment method your customer has selected, they may be redirected away from your website entirely to validate their payment information (for example, PayPal redirects customers to a separate window or pop-up to enter their payment credentials and then automatically returns them to the main payment page once they have provided all the necessary information).

- Processing: After receiving the customer’s payment details, the hosted payment gateway encrypts or tokenizes the payment data before sending it to the payment processor, who then communicates with the banks for authorization and approval. All of this communication can occur in a matter of minutes. Gateways can receive confirmation or denial of a transaction quickly to share with customers.

- Completion: Once a payment approval is received, the hosted payment gateway notifies the customer of the successful payment. Any worthwhile hosted payment gateway should have the ability to automatically redirect the customer back to your checkout interface for receipts, refunds, and other requests.

Benefits of Hosted Payment Gateways

Hosted payment gateways can offer many operational benefits, such as reduced compliance complexity and lower tech management costs. They have a lot to offer merchants in terms of simplicity and ease of use. Adding a hosted gateway to your payment stack is much more straightforward compared to building a gateway entirely in-house. All you need to do is connect to the gateway’s API, and the payment gateway provider can handle the rest from there.

Advantages of hosted payment gateways include:

- Streamlined payment processing and fraud risk management.

- Outsourced management of payment data storage and encryption.

- Minimal need for an extensive technical infrastructure for handling payment processing.

- Scalability for fluctuating payment volumes.

- Quick launch times for new businesses by setting up established payment gateways as part of their checkout experience.

Hosted payment gateways are ideal for businesses of all sizes operating in industries like ecommerce, SaaS, and subscription services. Managing a payments tech stack entirely in-house generates great costs that can quickly eat up your revenue. The same can be said for marketplaces that need a seamless way to serve customers in multiple regions and to power payments on their platforms.

For many businesses, the need for flexibility is great. Growing your company can result in drastic rises and dips in your payment volume. This makes it vital to choose a provider that can not only offer you the payment gateway capabilities you need but also customize that gateway according to the payment methods your customers prefer and the regions in which you operate.

Disadvantages & Drawbacks

Hosted payment gateways themselves do not have any apparent downsides, but there can be serious drawbacks to individual solutions. Working with a low-quality provider or one that does not allow you to work with multiple providers can lead to disadvantages like:

- A lack of payment page customization options, resulting in a checkout process that may be clunky or disruptive to the overall payment experience.

- Over-reliance on individual payment gateway providers. Should a provider have an outage, your payment performance (and, therefore, your customers) can suffer without a backup gateway or multi-provider strategy in place.

- Vendor lock-in is always an issue to keep in mind. Working with the wrong provider can force you to only use their services and solutions, even in scenarios where it would be more optimal for you to pair solutions from different providers. You should consider how you can improve your payments strategy by including more vendors, and setting up a multi-gateway system that prioritizes payment success and low costs.

- Integrating just one hosted payment gateway makes it difficult to avoid costly transaction or payment processing fees. By comparison, building your payments stack on a platform that allows for multiple integrations and providers can give you the freedom to route payments to the gateways with the lowest fees and highest chances of success.

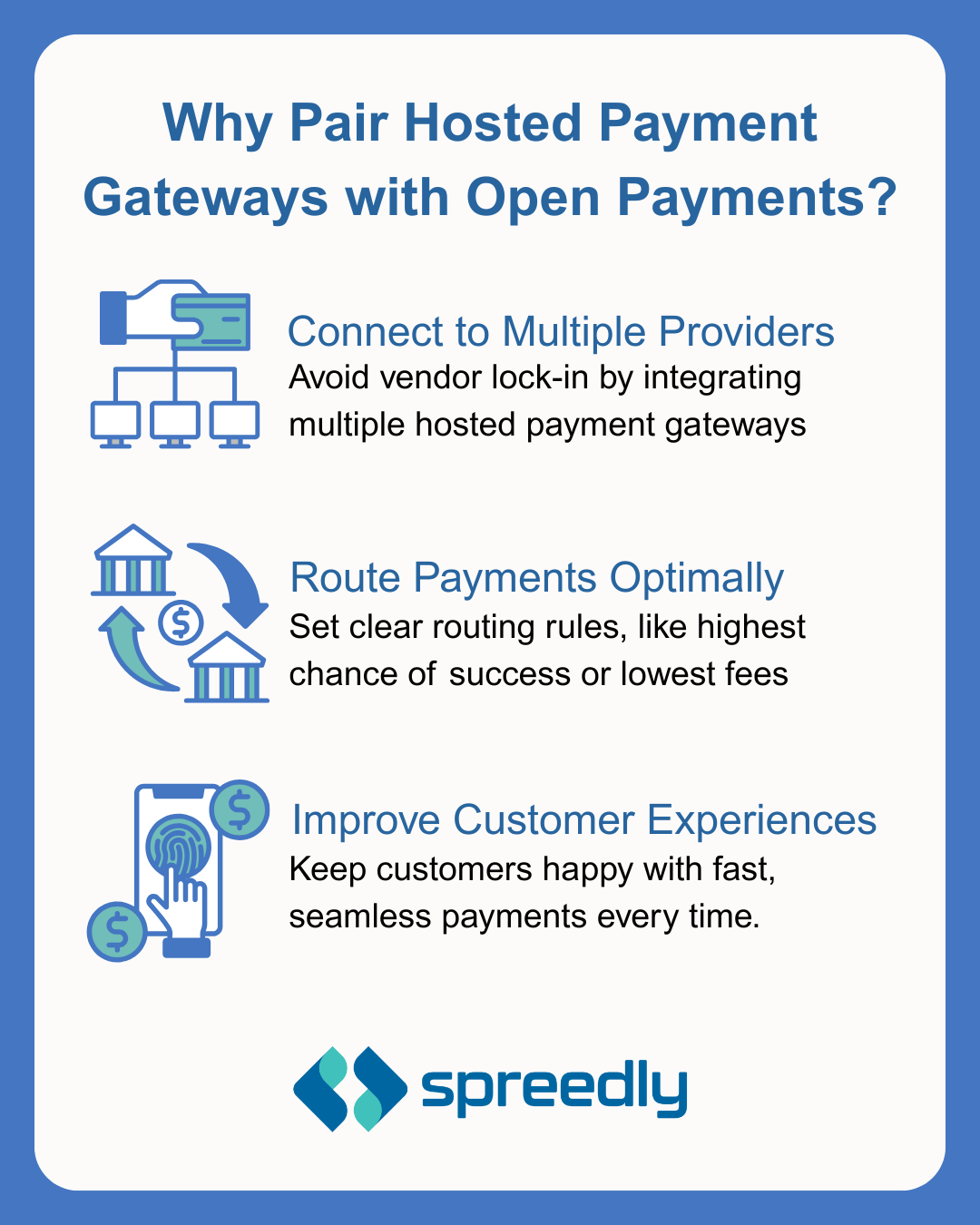

Open Payments + Hosted Payment Gateways = Ultimate Optimization

What merchants really need these days is a payment system that can connect them with multiple providers, all from a single API.

Open payment platforms offer this and more by allowing you to enable as many or as few payment gateways as you need. The ability to integrate with not only different gateways but also various payment and fraud tools gives open payment platforms an edge over any single provider.

Whether you prefer hosted or integrated checkout experiences, an open payments platform gives you the customization freedom to build your payments stack exactly how you want.

Is There a Difference for the Customer?

Open payments platforms can massively improve the customer experience.

The success of your business can depend greatly on the quality of your payment experience. Every hosted payment gateway solution is different from the next, especially as you expand into new regions and markets. An open payments platform enables a high degree of operational flexibility and can automatically route each payment to the optimal gateway.

All the behind-the-scenes efforts of transferring data from the payment gateway to the payment processor, issuing bank, and acquiring banks still happen as normal.

Customers generally never even know which payment gateway their information is sent to, but they certainly know when the payment process becomes delayed or if a payment fails altogether. Choosing to integrate and build from an open payments platform ensures every transaction is fast and that the checkout experience remains intuitive and satisfactory for the customer.

How Spreedly Can Enable Hosted Payment Gateways for Your Business

Spreedly can enable you to integrate hosted payment gateways with no problem, but why stop there?

Our open payments platform gives you the tools and technical environment you need to build a diverse payments stack with multiple connections to different gateway providers.

The Connect solution is designed specifically to help you integrate and organize more tools into your tech stack without adding undue operational or developmental burden to your team. Spreedly’s single, normalized API automatically gives you more powerful capabilities while still keeping integrations simple and allowing you to choose and implement your gateways of choice.

Through the unified view our platform provides, you gain clear oversight of your current payments setup. Our easy-to-use marketplace of connections makes it possible for you to experiment with different tools and providers without drastically raising costs or wasting resources.

Contact our team today to get started.